2023 at two speeds for the eyewear industry

After the marked rebound in GDP of 2021-2022, post lockdown, and a return to economic normality, the three global drivers -the United States, the European Union, and China- began to slow down, affecting the global scenario overall.

In 2023, the global economic scenario weakened, in Europe due to the negative impact of continuing high inflation and monetary tightening, in the emerging markets due to the dynamics of the Chinese economy, which is struggling more than expected.

Global manufacturing suffered a substantial setback. A number of factors contributed: the shift in consumption from goods to services, the weakening of European industry, and tougher conditions for demand, especially for investment, due to the tightening of credit and the gradual elimination of emergency policies.

This was reflected in a decline in world trade in goods, held back in particular by high geo-economic uncertainty, a strong dollar and multiplication of trade barriers.

In short, the post-Covid era continues to suffer from one of its most significant legacies: uncertainty.

While 2022 will be remembered for Russia's attack on Ukraine, 2023 will be recalled for Israel's war on Hamas, triggering a series of tensions in the Middle East, currently also resulting in the Suez Canal issue.

The italian economy in 2023

In 2023 the Italian economy slid back to the modest growth rates of previous decades, as did the European economy.

This was mainly due to rising interest rates after the pandemic and the energy crisis sent inflation rates soaring. In addition, once spending levels recovered, consumption growth rates began to decline; in 2023, at rates of about a quarter compared to those in 2022.

Rate increases are affecting domestic demand, and thus GDP, through the bank credit channel for households and businesses. For the latter, the cost of credit has increased. For households the same applies, mainly as a result of mortgages and consumer credit.

Trade was especially good in the first part of the year but then petered out in the last quarter.

Italian eyewear in 2023

The Italian eyewear trend was basically as follows: in the first half of the year, exports boosted the sector tremendously, continuing to grow at double-digit rates compared to 2022, while in the second semester the monthly export trend flattened out, where not actually down on the previous year.

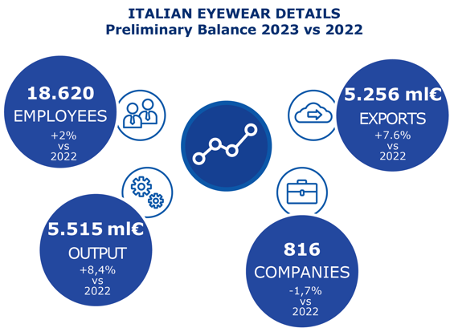

Based on the latest available data (October 2022), we have drafted the preliminary results for 2023, showing Italian eyewear production at 5.52 billion euros in 2023, up by 8.4% compared to 2022.

The total number of manufacturers fell by 1.7% to 816 companies nationwide.

On the employment front, the year-end seems to be positive so far: 18,620 employees, 2% higher than 2022.

Preliminary results exports 2023

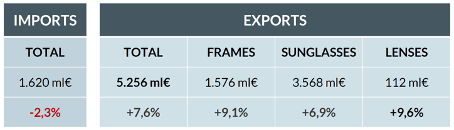

Again, based on forecasts for the period January-October 2023, exports of frames, sunglasses and lenses, which account for about 90% of industrial production, increased by 7.6% on 2022, reaching 5.26 billion euros.

In 2023, exports of sunglasses showed an upward trend of 6.9%, standing at about 3.6 billion euros.

Exports of frames, instead, increased by 9.1% to 1.6 billion euros.

The latest international developments have also weighed on the imports trend, which we estimate will close down by more than 2% compared to 2022, with a preliminary result for 2023 of about 1.6 billion euros.

The Italian eyewear industry’s trade balance has however increased (2023 export-import balance at 3.6 billion euros).

Preliminary results exports 2023: geographical areas

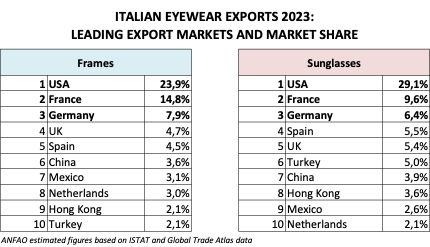

Looking specifically at the two product macro-segments – sunglasses and frames – by geographic area, we can see that:

- The primary market for exports in 2023 continued to be Europe (in 2023 exports remained constant at over 50% of all industry exports) with an upward trend of 12.4% (+13.6% sunglasses, +10% frames) on 2022.

- Italian eyewear sector exports to America accounted for about 33% of all exports in the industry in 2023. However, preliminary results for 2023 show a slowdown in exports of the sun-optical area of 3.4% compared to 2022. This was driven by the negative performance of sunglasses exports to North America (-8.3%). Preliminary results for exports to Central and South America and for frames were positive.

- Asia once again benefited from its new-found international mobility: the share of Italian exports aimed at the Asian area reached 14.8% in 2023 (but it was over 16% in 2019). The growth trend of exports was +22.3% compared to 2022 (exports of frames +16%, preliminary results for sunglasses +25%).

- Other geographic areas were of little significance and in the preliminary results were down on 2022 (-2.4% value in exports to Africa and -3.1% to Oceania).

Preliminary results exports 2023: countries

The export analysis by individual country shows that:

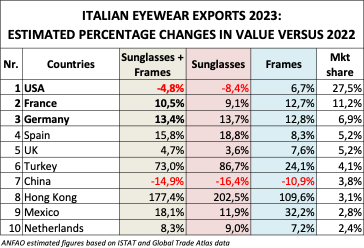

- In the United States (which has always been the main exports market for the industry, with a share of 27.5% in 2023), overall exports of frames and sunglasses fell by 4.82% compared to 2022. Preliminary results were mainly affected by the exports trend for sunglasses in the second half of the year, down by 8.4% unlike exports of frames, which, instead grew by 6.7% compared to 2022.

- In Europe, Italian exports to various countries performed very well compared to 2022. In France, preliminary results for exports in the sun-optical sector in 2023 increased by 5% compared to 2022 (+12.7% for frames and +9.1% for sunglasses). In Germany, overall growth was 13.4% up on 2022, divided into +13.7% for sunglasses exports and +12.8% for frames. For the second year in a row, preliminary results were again very good for exports to Spain up by 15.8% in value compared to 2022 (frames exports +8.3%, sunglasses exports +18.8%). Positive, though less brilliant preliminary results for Italian eyewear exports to the UK: overall exports were up by 4.7% in value compared to 2022, with +3.6% of sunglasses and +7.6% of frames. Preliminary results for exports of Italian eyewear to some northern and eastern European countries were also positive: Sweden (+8.1% on 2022), Poland (+14.7%), Croatia (+6.5%), Austria (+17.4%).

- We can conclude with the export trend of eyewear to the BRICs, which together in the preliminary results for 2023 account for just over 5% of the sector's exports (in 2019 over 8%): Brazil -1% on 2022, Russia +9.9%, India +18.8%, China -14.9%.

Preliminary results exports 2023: volumes

In 2023, the Italian eyewear industry exported 112 million pairs of glasses, slightly more than in 2022 (+2.7%).

Of the total number of glasses exported, 67 million were sunglasses (about 60%) and 45 million optical frames (40%).

Preliminary results domestic market 2023

Consumption, monitored by GfK on the specialized eyewear channel, performed well in the first half of 2023 (+4.3% in value compared to 2022). In the second semester, domestic consumption also slowed down, and the preliminary results we have elaborated for 2023 show growth in value slightly above 2022.

The sell-in figure also confirms these trends.

2024 forecast

According to the International Monetary Fund's World Economic Outlook, growth of the world economy slowed down in 2023 and will decline further in 2024, with the slowdown having a greater effect on developed countries than emerging countries. Among the causes of the slowdown, the report points to the war in Ukraine, increasing fragmentation of the economy, and some more cyclical factors such as anti-inflationary monetary tightening, withdrawal of government aid, and extreme weather events.

2024 started with new tensions and additional risks to trade flows due to the sharp reduction in transit through the Suez Canal: maritime traffic in the Red Sea fell by more than half in January. It should be kept in mind that 90% of trade volume is by sea and 12% was through Suez; for Italy, 54% of trade is by ship, 40% of which is through Suez. The longer the blockade is extended, the greater the negative effects on global and Italian foreign trade will be.

For the Italian eyewear industry, therefore, a complicated 2024 lies ahead, where the aspect of costs forcing companies to work with increasingly lower margins, is exacerbated by the difficulty of access to credit and weak foreign demand.

“2023 still ends on a positive note, exports and production have grown, the number of companies is basically stable and employment slightly up. This is witnessed,” says ANFAO President Lorraine Berton, “by MIDO, which opens in a few days in Milan, having a really high attendance by the industry, at the Italian and international level.”

“However, the outlook for the Italian economy in 2024 will continue to suffer, as in the previous year, from a slowdown in international trade and a rise in interest rates unprecedented in the history of the euro.” – continues the President – “We are all familiar with the international situation, wars, the Suez Canal question, geopolitical tensions between countries and tensions within countries (a great many), which are and will soon be affected by electoral dynamics, that only add to the general uncertainty. For our sector, exports are crucial; for us, more than for other sectors, foreign demand is the driver of Italian manufacturing and the acid test of our competitiveness in the world.”

“We are once again facing an uncertain situation, but – as before - our Association will do its share, supporting companies and staking our claim to the necessary instruments, which must necessarily include a new national and European industrial policy.”

“To maintain current levels of excellence and represent the most authentic Made in Italy, we ask the institutions to encourage investment: only by investing in new technologies and new skills can we truly innovate and be competitive. Companies must be assisted in the two main challenges of today: the digital transition and the green transition. Made in Italy itself embraces -in all its forms- the concept of sustainability. Our eyewear has always been well-designed and well-made, now it needs to also be increasingly sustainable and innovative. This is a goal we must pursue with all our strength, giving free rein to creativity and resources. On this matter, we are waiting to receive urgent responses which first and foremost necessarily regard the community resources in the field, Italy’s Recovery and Resilience Plan and cohesion funds” - emphasized Lorraine Berton.

“Then there is the Olympic factor reinforcing the link between eyewear and the local area, which needs to be exploited to the full” - Berton pointed out, also in her capacity as President of Confindustria Belluno Dolomiti and President of the Technical Group for Sport and Major Events of Confindustria. – “Milan and Cortina will be the main venues for the 2026 Olympics: on one side there is the capital of MIDO, on the other the Queen of the Dolomites, immersed in the Belluno Eyewear District. For the eyewear industry, these Games are not a mere coincidence, but a strategic opportunity, where the beauty of the venues reflects that of the products. The Olympics are not just a sports and tourism event, but an opportunity for manufacturing itself: a showcase of Made in Italy that it is up to us to make the most of. ANFAO has already taken steps in this direction: the Olympics will bring talent and infrastructure that could become crucial for our industry.”

ANFAO elaborations on data from ISTAT, Coeweb, Global Trade Atlas, INPS, CCIAA, Cerved Atoka.